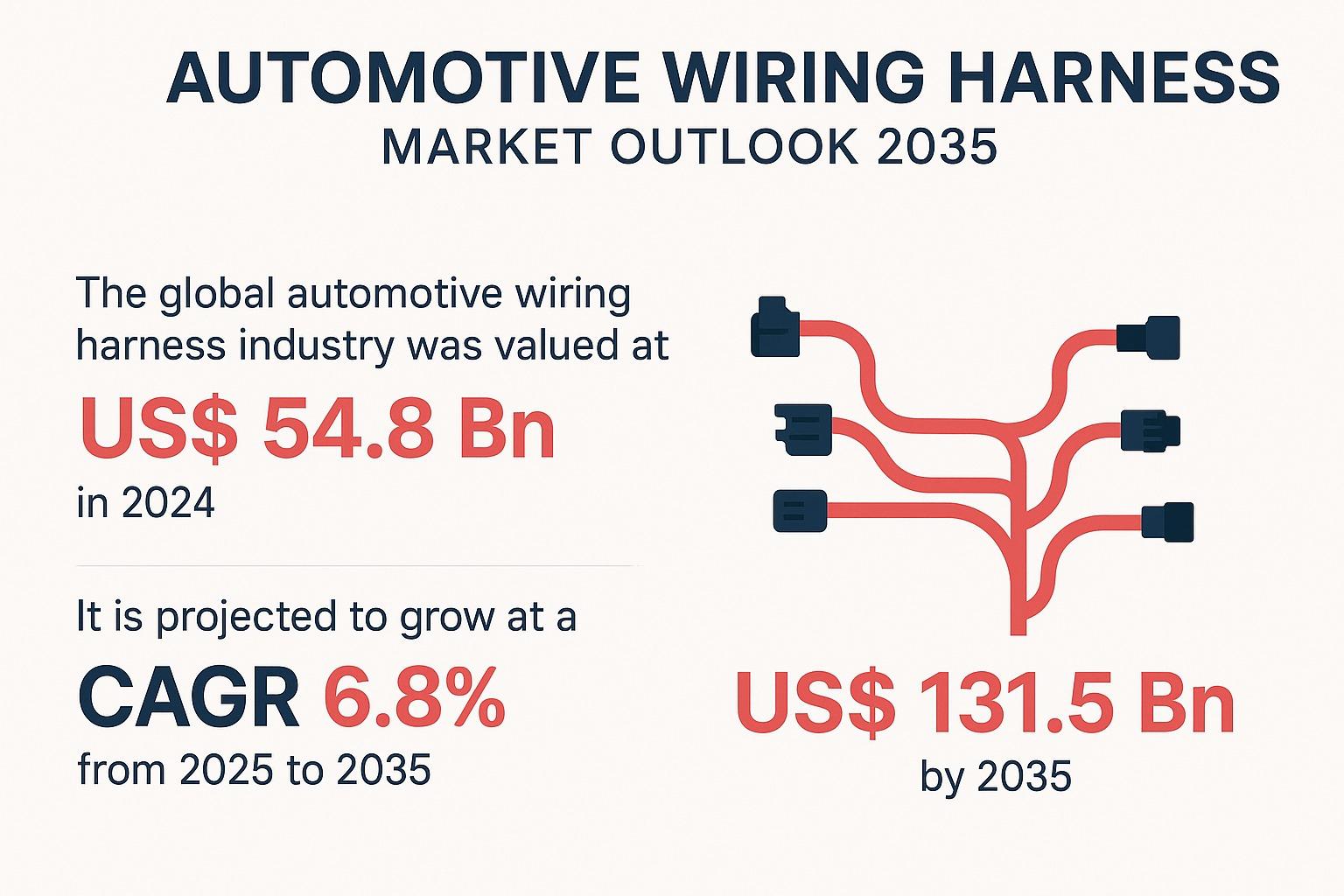

In today’s rapidly transforming automotive industry, the automotive wiring harness acts as the central nervous system of vehicles—carrying signals, power, and information across every major system. As vehicle technology advances, so does the complexity and demand for sophisticated wiring systems. According to the latest market outlook, the global automotive wiring harness market was valued at US$ 54.8 billion in 2024 and is projected to reach US$ 131.5 billion by 2035, growing at a CAGR of 6.8% from 2025 to 2035.

This sharp rise is fueled by three primary drivers: the rapid electrification of vehicles, increased adoption of advanced driver-assistance systems (ADAS), and the growing integration of infotainment and connectivity solutions.

Understanding the Automotive Wiring Harness Market

An automotive wiring harness is a structured assembly of wires, connectors, and terminals that transmits electrical power and control signals to different components within a vehicle. From lighting and infotainment to engine management, HVAC, and safety systems, wiring harnesses play a critical role in ensuring efficient performance and safety.

The market can be segmented based on several parameters including:

-

Vehicle Type: Passenger vehicles, commercial vehicles, and electric vehicles.

-

Material Type: Copper, aluminum, and advanced lightweight materials.

-

Application: Chassis, dashboard, engine, battery, HVAC, and lighting systems.

With automakers striving for lightweight designs, modular architectures, and improved thermal durability, manufacturers are continuously innovating to deliver advanced wiring solutions that meet regulatory and performance standards.

Market Drivers: Electrification, Automation, and Innovation

1. Rapid Electrification of Vehicles

The automotive sector is undergoing a profound shift toward electric (EV) and hybrid electric vehicles (HEV). These vehicles require complex high-voltage wiring systems to power battery packs, electric drivetrains, and onboard charging systems.

EVs and HEVs not only need standard vehicle harnesses but also specialized systems that handle high current and voltage, with added insulation and thermal protection. As global EV production accelerates—driven by environmental policies and government incentives—the demand for customized, modular, and heat-resistant wiring harnesses will rise exponentially.

Countries around the world are investing heavily in sustainable mobility, pushing automakers to rethink traditional wiring designs to meet efficiency, safety, and durability requirements.

2. Growing Adoption of Advanced Driver-Assistance Systems (ADAS)

Safety and automation have become top priorities in vehicle design. Modern vehicles now feature ADAS technologies like adaptive cruise control, lane-keeping assist, automatic emergency braking, and blind-spot detection—all of which rely on a network of sensors, cameras, radar, and ECUs interconnected by high-speed wiring harnesses.

The integration of ADAS dramatically increases wiring complexity. Harnesses must now handle high-speed data transmission, signal integrity, and electromagnetic shielding to ensure reliable performance.

As automakers move toward autonomous and semi-autonomous driving, the need for Ethernet-based and fiber optic wiring harnesses capable of handling massive data loads is expected to surge. This technological leap makes ADAS a key growth pillar for the wiring harness industry.

3. Expansion of Infotainment and Smart Connectivity

Consumer expectations are reshaping automotive design. The modern driver demands real-time navigation, entertainment streaming, voice recognition, and seamless smartphone integration. These infotainment and connectivity systems significantly increase the number of wiring connections and the sophistication required in vehicle harnesses.

As vehicles evolve into “smart devices on wheels,” wiring harnesses must be designed to accommodate 5G connectivity, over-the-air (OTA) updates, and in-car networking for a more immersive experience.

Market Segmentation Insights

Passenger Vehicles Dominate the Market

Passenger vehicles currently hold the largest share of the global automotive wiring harness market. Rapid urbanization and rising disposable incomes—particularly in markets such as China, India, and Japan—are fueling demand for vehicles equipped with advanced electronics and luxury features.

The electrification of passenger cars further strengthens this segment, as EVs require more high-voltage wiring to support battery systems and electric powertrains. From ADAS integration to connected infotainment, wiring harness density and complexity are rising sharply in this category.

Regional Outlook: Asia Pacific Leads the Charge

The Asia Pacific region dominates the global automotive wiring harness market and is expected to maintain its leadership through 2035. Countries such as China, India, Japan, and South Korea are global automotive manufacturing powerhouses, supported by robust infrastructure, low production costs, and high consumer demand.

Key factors driving the region’s growth include:

-

Massive automotive production volumes.

-

Strong EV adoption and government incentives for clean mobility.

-

Technological advancements and investment in lightweight, efficient wiring systems.

China, in particular, serves as a major hub for high-volume wiring harness production, catering to both domestic and international OEMs. Regional suppliers collaborate closely with automakers, materials companies, and logistics networks, creating a dynamic and efficient supply chain ecosystem.

Challenges and Opportunities

While the market’s long-term outlook remains positive, several short-term challenges persist:

-

Semiconductor shortages have disrupted production schedules.

-

Raw material price volatility—especially copper—poses cost challenges.

-

Supply chain bottlenecks have slowed throughput in certain regions.

However, these challenges also open doors for innovation. The push for lightweight, heat-resistant, and eco-friendly materials, as well as modular wiring architectures, offers growth opportunities for both new entrants and established players.

Furthermore, strategic collaborations and joint ventures with EV manufacturers are expected to unlock new design and production capabilities. Wiring harness suppliers that align with sustainability goals and electrification trends will be best positioned to lead the next wave of growth.

Competitive Landscape: Key Players and Developments

Major companies shaping the automotive wiring harness market include:

BorgWarner Inc., Continental AG, CTS Corporation, DENSO Corporation, Dhoot Transmission, Furukawa Electric Co., Ltd., Hella GmbH & Co., KGaA, Hitachi Ltd., Johnson Electric, Lear Corporation, Leoni AG, Sumitomo Electric Industries, Mitsubishi Corporation, NIDEC CORPORATION, and Robert Bosch GmbH.

These firms focus on technological innovation, product diversification, and strategic alliances to expand their global presence.

Recent Developments:

-

May 2025: BorgWarner secured a contract to supply its 400 V SW130 eMotor to a North American OEM for hybrid trucks and SUVs.

-

March 2025: Furukawa Electric Co. Ltd. announced a restructuring of its optical fiber and metal wire businesses under the new brand Lightera, streamlining its operations for greater efficiency.

Such initiatives highlight the industry’s focus on sustainability, electrification, and digital innovation to meet evolving mobility demands.

Conclusion: The Future is Wired and Electric

The automotive wiring harness market is entering an era of unprecedented transformation, fueled by electrification, automation, and smart mobility. As vehicles become more intelligent and connected, wiring harnesses will continue to evolve from simple electrical systems into data-driven lifelines that define vehicle performance and safety.

With the market expected to more than double in value by 2035, industry participants must embrace technological innovation, modular design, and strategic partnerships to capture the emerging opportunities in this electrified future.

The road ahead is wired for growth—and those harnessing innovation will lead the drive toward a smarter, safer, and more sustainable automotive world.