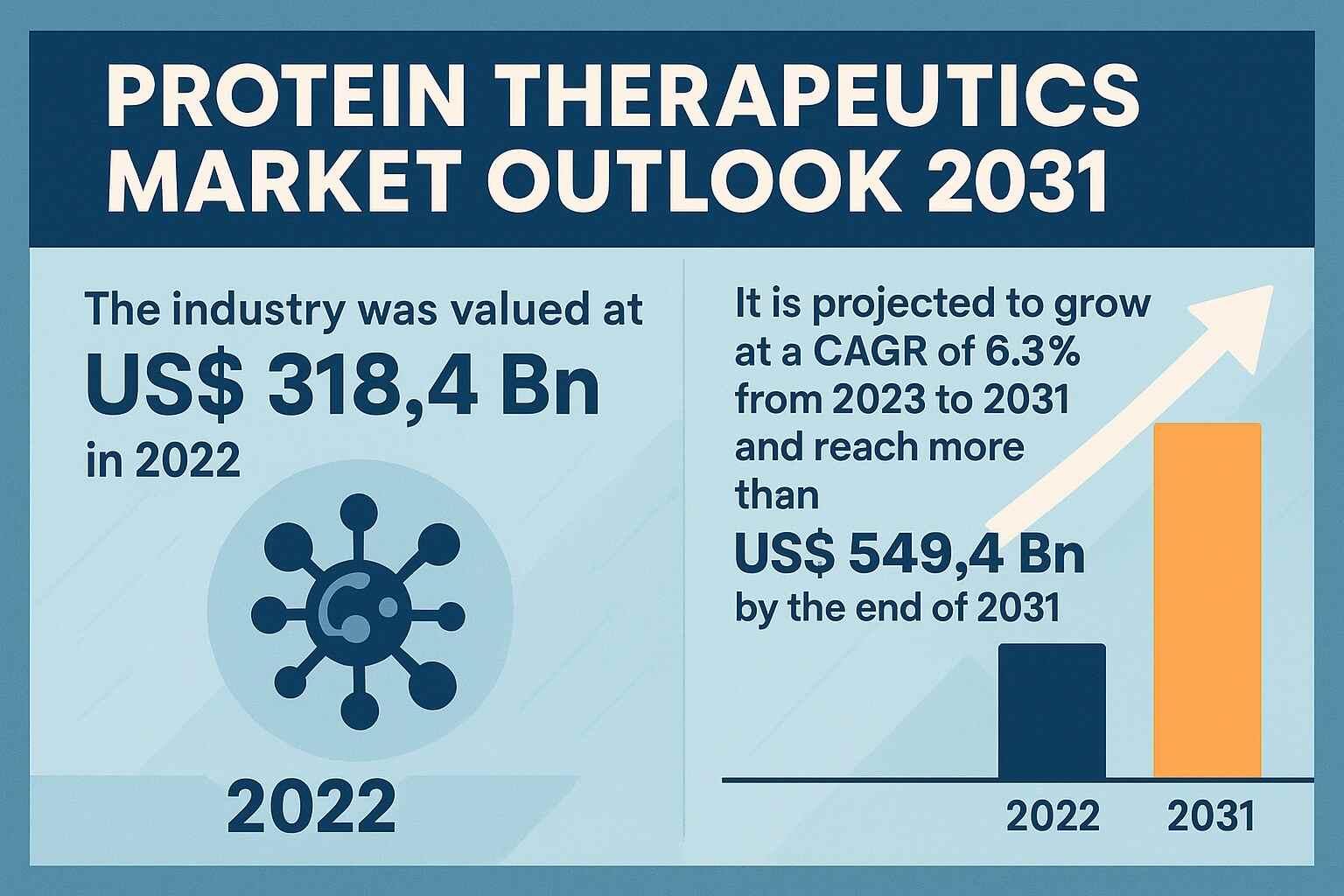

The Protein Therapeutics Market is advancing rapidly as biopharmaceutical innovation, disease-driven demand, and modernization of manufacturing systems intersect to redefine global treatment standards. Valued at US$ 318.4 Bn in 2022, the market is expected to surpass US$ 549.4 Bn by 2031, registering a strong CAGR of 6.3% during the forecast period.

Expanding Therapeutic Applications Strengthen Market Momentum

Protein therapeutics have moved beyond traditional use cases and are now employed across a wide spectrum of diseases, including:

-

Metabolic disorders such as diabetes

-

Immunologic diseases including rheumatoid arthritis and lupus

-

Hematological disorders like hemophilia

-

Cancer across multiple tumor types

-

Genetic disorders, including rare diseases

The versatility and biological specificity of therapeutic proteins make them ideal for addressing complex disease pathways where conventional therapies often fall short.

Advanced Biomanufacturing Enhances Scalability and Quality

Global demand for therapeutic proteins has accelerated advancements in biomanufacturing technologies, including:

-

Single-use bioreactors for flexible and cost-effective production

-

Continuous bioprocessing to improve efficiency and reduce downtime

-

High-throughput cell line development for optimized protein yield

-

AI-enabled production monitoring for superior quality control

-

Gene editing tools (CRISPR) enhancing protein expression systems

These innovations reduce production costs, accelerate time-to-market, and expand access to biologics — especially in emerging markets.

Monoclonal Antibodies Dominate Product Landscape

The monoclonal antibodies (mAbs) segment continues to hold the largest market share due to:

-

Exceptional therapeutic precision

-

High adoption in oncology and immunology

-

Breakthroughs in bispecific mAbs, ADCs, and checkpoint inhibitors

-

Robust clinical pipelines from major biopharma companies

mAbs remain the flagship category leading protein therapeutics innovation.

Biosimilar Expansion Boosts Global Accessibility

As patents for blockbuster biologics expire, biosimilars are accelerating market democratization. Their impact includes:

-

Lower treatment costs

-

Increased availability in low- and middle-income countries

-

Enhanced market competition

-

Supportive regulatory guidelines across major regions

Biosimilars are expected to drive aggressive market expansion through 2031, especially in Asia-Pacific, Latin America, and Eastern Europe.

Cancer Continues to be the Largest Application Segment

The rising global cancer burden makes oncology the leading therapeutic area for protein drugs.

Key drivers include:

-

Proliferation of targeted therapies

-

Continued approvals of ADCs and checkpoint inhibitors

-

Increased R&D investment in tumor-specific biologics

-

Shift toward personalized oncology solutions

Protein-based therapies now form a core component of frontline cancer treatment in many regions.

Regional Growth Highlights

North America

-

Strong ecosystem of biotech companies

-

High investment in R&D and clinical trials

-

Favorable biologics regulatory environment

-

Advanced healthcare infrastructure

Asia Pacific

-

Fastest-growing market due to population size and chronic disease prevalence

-

Major investments in biologics manufacturing (China, India, South Korea)

-

Rising adoption of biosimilars

-

Government initiatives supporting biopharma expansion

Asia Pacific’s growth trajectory positions it as a major global biologics hub by 2031.

Competitive Landscape: Innovation Through Collaboration

Key players include:

Thermo Fisher Scientific, Sanofi/Genzyme, AbbVie, Takeda, Bayer, Bristol-Myers Squibb, Daiichi Sankyo, Abbott, Leadiant Biosciences, Amicus Therapeutics.

Strategic developments such as:

-

Thermo Fisher’s acquisition of PeproTech (2022) to strengthen recombinant protein offerings

-

AbbVie–Plexium partnership (2022) targeting protein degradation therapies

highlight the sector’s focus on collaboration-driven innovation.